Dow Jones futures were higher late Monday ahead of key Russia-Ukraine cease-fire talks Tuesday. Treasury yields paused, while U.S. oil prices dived Monday. Dow Jones tech titan Apple and Tesla stock are rapidly approaching buy points.

Amid a strengthening stock market uptrend, investors have the green light to continually raise exposure by buying top stocks breaking out past proper buy points. You can find stock ideas by monitoring IBD’s proprietary watchlists, like the IBD 50 and the IBD Big Cap 20.

Stock Market Today

On Monday, the Dow Jones Industrial Average rose 0.3%. The S&P 500 gained 0.7% and the tech-heavy Nasdaq composite climbed 1.3%. The S&P 500 extended a win streak to three sessions. Among exchange traded funds, the Nasdaq 100 tracker Invesco QQQ Trust (QQQ) rose 1.55%, and the SPDR S&P 500 ETF (SPY) advanced 0.7% Monday.

Among the Dow Jones leaders, Apple (AAPL) rallied 0.5% and Microsoft (MSFT) traded up 2.3% in today’s stock market. UnitedHealth, a Dow Jones stock to watch, remains in buy range after a recent breakout.

Electric-vehicle leader Tesla (TSLA) surged more than 8% higher Monday after the company announced plans to split its stock.

Amid the volatile, headline-driven market, IBD Leaderboard stock Arista Networks (ANET), Broadcom (AVGO), CVS Health (CVS), European Wax Center (EWCZ) and Regeneron Pharmaceuticals (REGN) are Monday’s top stocks to buy and watch.

Microsoft and Tesla are IBD Leaderboard stocks. Arista is an IBD SwingTrader stock. Apple was featured in this week’s Stocks Near A Buy Zone column. European Wax Center was last week’s IPO Stock Of The Week.

Dow Jones Futures Today: Oil Prices, Treasury Yields, Russia-Ukraine Talks

After Monday’s market close, Dow Jones futures rose 0.1% vs. fair value, while S&P 500 futures inched higher. Nasdaq 100 futures were down 0.1% vs. fair value. Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

The 10-year U.S. Treasury yield eased to 2.47% Monday, holding at its highest level since May 2019 following Friday’s surge. U.S. oil prices dived more than 9% Monday, as West Texas Intermediate crude traded below $104 a barrel. Dow Jones energy giant Chevron (CVX) declined almost 2%, but remains sharply above the 20%-25% profit-taking area from a cup base’s 113.21 entry.

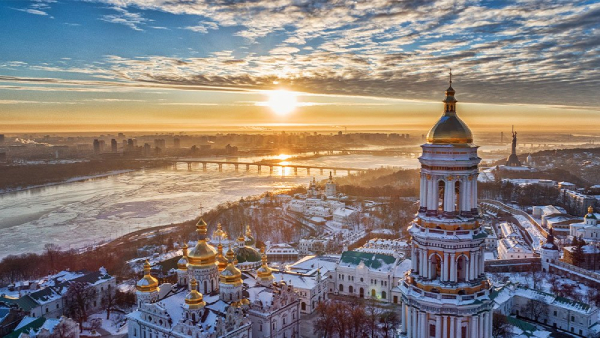

Russia-Ukraine cease-fire talks — to be held in Istanbul, Turkey — are scheduled to start Tuesday morning. Previous talks between the Russian and Ukrainian foreign ministers ended with no agreements on a cease-fire or other humanitarian issues.

Stock Market Rally

The stock market posted positive results Monday, as the Nasdaq and S&P 500 ended with solid gains. For more daily stock market commentary, check out IBD’s The Big Picture column.

Friday’s The Big Picture column commented, “Also encouraging? Following the prior week’s powerful advance that encapsulated follow-through days by both the S&P 500 and the Nasdaq, the market refused to surrender those gains.”

If you’re new to IBD, consider taking a look at its stock trading system and CAN SLIM basics. Recognizing chart patterns is one key to the investment guidelines. IBD offers a broad range of growth stock lists, such as Leaderboard and SwingTrader.

Investors also can create watchlists, find companies nearing a buy point, or develop custom screens at IBD MarketSmith.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Unique Analyst journalist was involved in the writing and production of this article.