–News Direct–

Bettormetrics, an innovative company providing competitive sports odds intelligence and insight to the sports betting industry, reported today through its latest data analysis, that the leading US sportsbooks are potentially losing tens of millions of dollars in revenue due to length of suspension times during live sport contests.

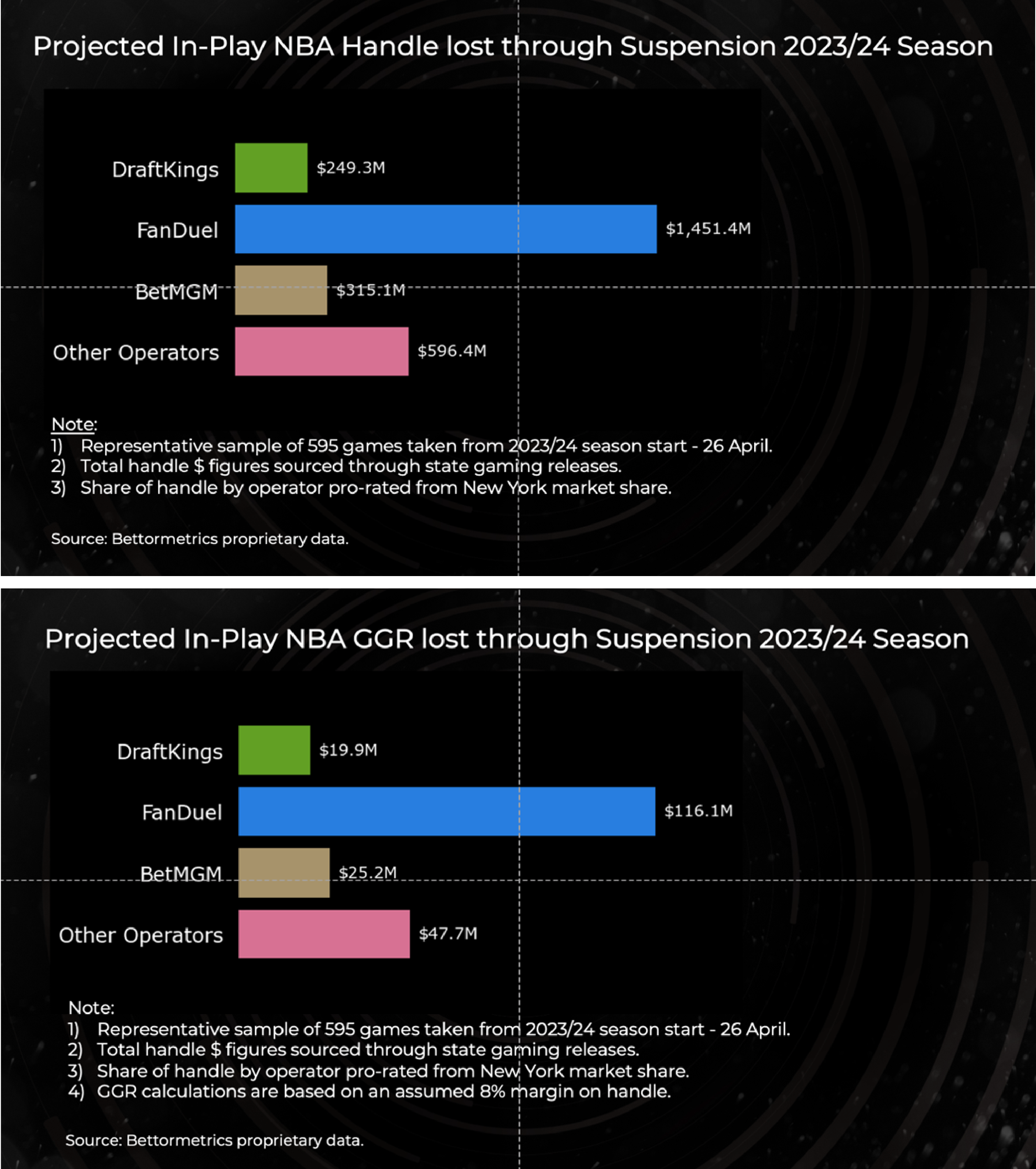

According to the findings, FanDuel led the top three sportsbooks in potential revenue lost, leaving an estimated $1.45 billion in handle on the table with an average suspension rate of 15.8% (84.2% uptime) per fixture. DraftKings, although best in class, leaves a potential $249 million in handle with an industry leading suspension rate of 4.8% (95.2% uptime) The analysis was done leveraging NBA betting data for the 2023-2024 season.

While suspension is an inevitable occurrence in sports betting as traders necessarily evaluate the risks surrounding new situations within games, some sportsbooks are more systematically cautious than others. Its this situational nuance that leads to more sportsbooks looking at risk instead of the potential rewards around improving its average uptime said Robert Urwin, CEO and co-founder of Bettormetrics. In looking at our NBA data of the top three US sportsbooks, its clear to see the suspension strategies and the risk management perspectives of each books trading desks. While FanDuel is potentially losing out on the most revenue, based on its incredible volume, with a few optimizations it can dramatically increase its margins and create distance between itself and DraftKings as the definitive leader in US sportsbook operations.

Suspension is when a sportsbook periodically shuts down betting lines in a sporting event to readjust the odds based on activity within the event (a basket, touchdown, goal, penalty, key injury, etc.). Each sportsbook handles suspension differently and for different periods of time. Depending on the length of time the odds are suspended, sportsbooks are losing the opportunity to accept new bets and can potentially lose active users to other sportsbooks, should odds be shut down for extended periods of time.

Every operator is looking for ways to grow their margins, increase wagering and reduce customer attrition. While many sportsbooks externalize their focus on the cost of user acquisition, suspension can help a sportsbook find new revenue from within by becoming more efficient than their competitors, said Sabin Brooks, Commercial Director of Bettormetrics. In the US, market share is gained in very slim percentage points. By understanding and addressing these crucial trading efficiencies, sportsbooks can gain potentially billions in lost revenue. A poor suspension strategy is very bad business for customers and shareholders alike.

Suspension is just one element of overall sportsbook performance. Bettormetrics monitors and analyzes thousands of live in-play sports betting events traded every single week. Observed performance and competitive analysis by Bettormetrics has already helped traders and analysts discover and ameliorate deficiencies that directly impact sportsbook revenues and profitability.

About Bettormetrics

Bettormetrics is an innovative company providing competitive sports odds intelligence and insight to the sports betting industry. Bettormetricss Trading Analytics Platform is a SAAS product supporting sportsbook trading desks with cutting edge insight and analysis on the entire event life cycle, helping sportsbooks, data suppliers and B2B platforms gain an edge on competitors and ensure no profits are left on the table. For more information, please email info@bettormetrics.com or visit Bettormetrics.com.

Contact Details

Digital Sport by Hot Paper Lantern

Bailey Irelan

Square In The Air

Ben Cleminson

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/ai-sports-odds-intelligence-firm-bettormetrics-finds-us-sportsbooks-leave-billions-in-handle-on-the-table-due-to-poor-suspension-strategies-434125370

Bettormetrics

COMTEX_451785271/2655/2024-05-02T12:49:36

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Unique Analyst journalist was involved in the writing and production of this article.